Sep 7, 2021

Italian Paper IDs: How to solve for the onboarding oversights costing you conversions

The Fourthline Team

Fourthline explores the challenges associated with paper IDs in the Italian market and how enterprises can leverage best-in-class technology to optimize their KYC flow.

Digitalization has been a formidable force in recent years, transforming customer onboarding and due diligence processing in financial and consumer-facing industries.

But the shift is not yet universal. There are still many parts of the world that continue to use paper identity documents (IDs), and organizations operating in these markets must process them despite the many challenges they present.

Italy is a prime example. Paper-based IDs in the country are prone to fraud and subject to considerable regional inconsistencies, rendering them impossible to process for many identity verification solutions.

Italy: a labyrinth of identity documents

Regulated industries onboarding Italian clients must manage both electronic and paper-based IDs. Although the Italian eID card (Carta di Identità Elettronica or CIE) was launched in 2016, and millions of these new security cards have since been issued, the process of rolling them out to all 60 million-plus Italian citizens will take years. Italy’s governance structure is complex: organized in regions, provinces, municipalities, and metropolitan cities. Each may adopt its own rules, and each is at a different stage of development and modernization. So while many European countries have plastic ID cards with embedded security features, Italy has not yet implemented this nationwide.

“Italy is one of the largest European countries in terms of population and with nearly eight thousand municipalities issuing ID cards, it will take a lot of time for all Italian citizens to receive their new card,” explains Fourthline’s Senior Knowledge Management Expert Alexandra Poshtarenko. “The roll out also relies on the individuals to request the new IDs and this exacerbates the problem.”

In the meantime, organizations must find ways to manage paper IDs alongside eIDs. That means preventing fraud, reducing handling time, increasing quality conversions, and adhering to compliance regulations without compromising efficiency and the user experience.

Regional discrepancies create confusion

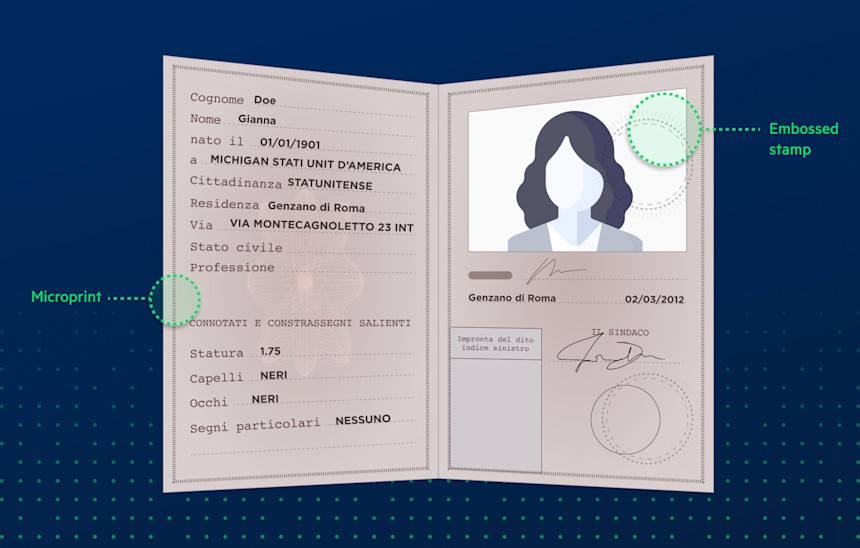

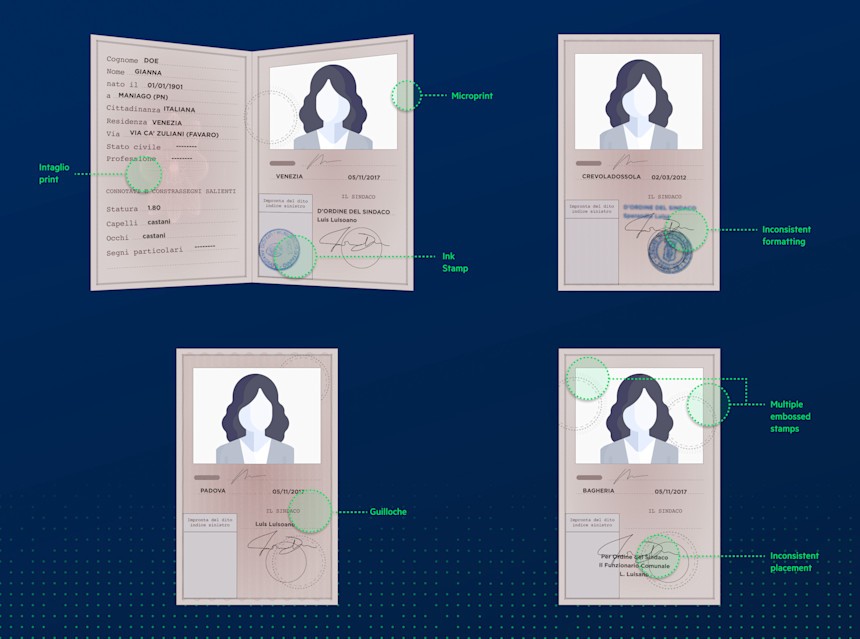

While electronic ID cards have standardized security features to protect against fraudulent activity, the features of paper IDs vary considerably and are much easier to falsify. In Italy, the ID booklet itself may be comparatively the same to another, but the way the information appears inside is open to interpretation by differing regional jurisdictions. This results in inconsistent criteria for the placement of official seals and stamps, the types of fonts used, or how the photo is attached – it may be glued, covered with film, or simply attached with a clip.

“Sometimes they use ink stamps, sometimes they emboss it, sometimes it’s one stamp, sometimes two, sometimes three,” says Fourthline’s Poshtarenko. “Sometimes there is a signature and the name of the person who issued the ID, sometimes it is missing completely."

Sometimes they use ink stamps, sometimes they emboss it, sometimes it’s one stamp, sometimes two, sometimes three.

As you might expect, ID documents in larger, more populous cities are more standardized and the quality of the documents is higher. But in the smaller, more remote towns, especially in the south of the country, there are genuine ID cards that contain handwriting.

This lack of standardization has a twofold impact on fraud prevention: it makes IDs easier to falsify and it makes it harder for AI-based technology to read the data that must be extracted and cross-verified during the sign-up process.

How to protect your business

Managing so many ‘acceptable’ variations makes it difficult to extract data and to authenticate identification documents in a way that is both timely and accurate. Tackling the inconsistencies requires a complex blend of processes and technologies but there are some key measures that regulated institutions should have in place:

1. In-depth knowledge of ID document features

Identifying potential fraud requires a deep knowledge of the features of authentic documents in order to establish the ones that fraudsters have failed to replicate.

At Fourthline, we have in-house experts dedicated to continuous research into security features in different countries to ensure that we are always up to date and a step ahead of fraudsters. Alongside this dedicated research, we have also accumulated knowledge and expertise through our experience of working in each specific market and with each document type. Combining all this intelligence allows us to determine whether a particular paper ID is authentic. This is constantly reviewed and updated in our guidelines and training programs.

With strict rules and parameters in place, our in-house analysts can perform a series of data validation checks.

“We know the patterns for each paper ID, we know exactly what the genuine documents look like, and we can therefore detect which might indicate fraud,” says Poshtarenko. “We define certain kinds of acceptability scenarios required to pass an audit, including: how many stamps do you see? What is the photo attachment method? Among other things, we define the less risky scenarios and the higher risk ones that we might not accept.”

We know the patterns for each paper ID, we know exactly what the genuine documents look like, and we can therefore detect which might indicate fraud.

2. Adaptable identity verification technology that can manage any input

Once you have detailed knowledge of the security features required for each document, the next stage is capturing the right input to check for those security features. During an application, for example, Fourthline asks the customer for a tilted photo of their ID document.

Paper IDs are particularly troublesome for organizations that need to digitally onboard customers, especially when many fraud detection technologies are unable to process non-rigid inputs. Digital ID cards are standardized and their features can be quickly and easily read by identification and verification (ID&V) solutions, which employ automated algorithms and machine-learning models to make document and identity verification quicker and more accurate. Data can be automatically extracted from a document like a passport or driving license, for example, because the document has a Machine-Readable Zone (MRZ) that is specifically developed for this purpose. Information can also be retrieved from the chip in most ID documents using Near Field Communication (NFC). This can easily be inputted at home using a smartphone.

While other systems may struggle to interpret paper IDs, Fourthline’s in-house technology has adapted to extract the necessary data and process paper documents much more efficiently. We have developed a robust solution that can manage non-standardized features and image capture - including non-rigid cards like Italian paper IDs - in bulk volume while still delivering superior fraud detection standards.

How? Fourthline’s technology first performs several pre-processing steps on the image of the ID card. We normalize the ID card input and transform it into a controlled domain before proceeding with further algorithmic steps. The pre-processing can be applied to any type of identification document (such as ID card, passport, permit, or driving license) for any nationality, taken in any light condition. The document can display any kind of rotation and translation in any axis as well as any kind of background. It can be partially occluded (be obscured by fingers for example) or not entirely in the image.

It then applies extensively trained, deep learning AI algorithms for Optical Character Recognition (OCR) - these processes assess the information that is completed during the application and the information on the ID document.

"Rather than relying on off-the-shelf software, we build our OCR network architectures from scratch using state-of-the art recurrent convolutional neural network architectures and train them directly on data within our domain," says Dr.-Ing Sebastian Vater, Head of Artificial Intelligence at Fourthline, "By adapting our solutions to the domain we are active in, we enable highly robust and accurate machine learning models.”

Rather than relying on off-the-shelf software, we build our OCR network architectures from scratch...

The individual Visual Inspection Zone (VIZ) fields are also checked: Take as an example the birth date field - one of the checks an analyst typically needs to perform is to confirm whether the applicant is old enough. For an analyst, this means a couple of manual steps from locating the birth date on the document, reading it, and then comparing it to today's date. Finally, an analyst calculates whether the person is 18+ years old. At Fourthline, this process can be fully automated. Our OCR solution reads every single field automatically in the VIZ. We can achieve this for Italian paper ID cards at the same speed and accuracy as other documents.

3. Additional safeguards

In addition to the paper ID card, which is taken as the primary ID, we also request a secondary document, which can be either a driving license or health insurance card. In this way, we aim to improve accuracy for our clients by deterring fraudsters with an extra layer of security.

Fourthline recognizes the challenges that face financial institutions operating in Italy and has taken the necessary steps to ensure secure onboarding of all Italian end customers, wherever they are based. In addition to our team of fraud experts, we offer a solution that is 100% locally compliant, covering both electronic and paper IDs and accounting for any regional discrepancies.

Our automated approach paired with our team of anti-fraud experts is optimal for enterprises looking to reduce risk and increase business efficiency.

What does this mean for your business?

Increase conversions: using a robust solution that can manage all ID formats, with the same level of accuracy and efficiency, results in a frictionless service for both the organization and the customer, resulting in fewer customer drop-offs.

Reduce handling time: using an automated KYC process, that harnesses the highest quality technology, means that all IDs – even non-rigid paper IDs - can be processed as quickly as possible.

Produce higher quality results: catch more fraud and your business reaps the rewards. This is not just about being more efficient or reducing costs – it's about being better at what you do. The right fraud detection process helps you identify risks faster and more accurately, protecting your organization from financial crime, while also having a ripple effect on the rest of your business, validating it as a trusted partner to the wider community.

Are you seeking expert guidance on how to optimize your onboarding flow? We can help. Select the Contact Us button below.