Jul 23, 2020

Traditional banks still have a lot to learn from neobanks about KYC and onboarding

The Fourthline Team

Fourthline recently evaluated the customer onboarding process at financial institutions across Europe. Our findings revealed a widening chasm between consumer demand for a fully digital experience and legacy bank processes that neither meet customer needs nor adequately prevent fraud. European financial institutions—specifically, traditional banks—must reconsider their onboarding models in order to accommodate rising consumer expectations for a simple and smooth, fully digital experience.

Our analysis revealed that neobanks—defined as banks without physical branches—far surpassed traditional banks in providing seamless onboarding. Unsurprisingly, every neobank we evaluated offered a completely online onboarding process, including digital KYC.

Among traditional banks, though, only 52 percent permitted digital onboarding—meaning that nearly half require new customers to visit a local office to fulfill signup requirements. Of the ones that do offer digital onboarding, 80 percent provided an experience that we deemed inadequate.

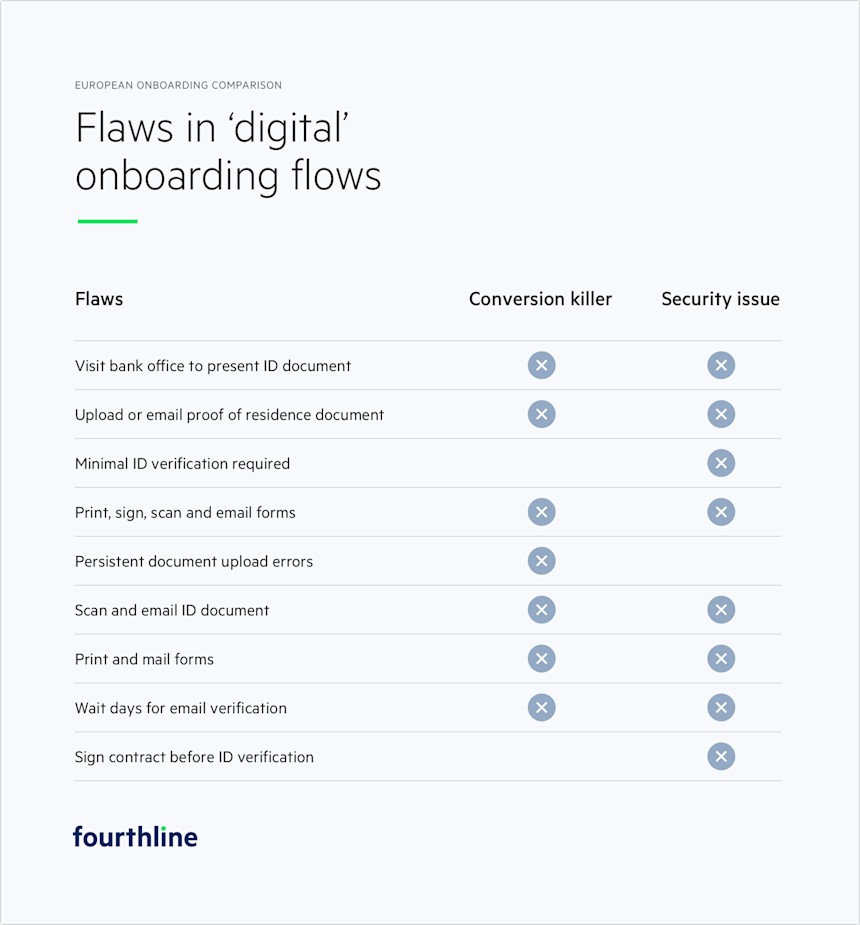

These flawed signup flows were disrupted by conversion killers like multi-day email verification delays and persistent document upload errors. In addition, the flows frequently relied on easily-falsified proof of residence documents to confirm a customer’s whereabouts, instead of more trustworthy methods like device metadata and geolocation analyses to meet KYC requirements.

The most common flaws we found in what were supposedly 'digital' onboarding processes:

The inability to offer an effective and compliant digital onboarding experience places traditional banks at a competitive disadvantage that has only been magnified by the ongoing pandemic.

It’s no secret that the world has moved online at an accelerating pace over the past few months, as digital processes and interactions have rapidly displaced manual ones in every industry, including banking. According to Deloitte, “Even customers who were reluctant to adopt digital interactions have done so out of necessity, gaining some level of comfort with these new methods.”

Banks that don't offer digital onboarding (or provide a faulty version of it) find themselves in the unsustainable position of relying on an archaic process that is costly, vulnerable to fraud, and increasingly at odds with customer preferences. As a recent McKinsey insight noted, “Once they are acclimated to new digital or remote models, we expect some consumers to switch permanently or increase their usage, accelerating behavior shifts that were already underway.” In fact, consumers are rapidly becoming reliant on fully digital experiences.

Of the traditional banks that do offer digital onboarding, 80 percent provided an experience that we deemed inadequate.

To adapt to both new consumer preferences and continued limitations on personal contact, banks must streamline their onboarding journeys—or expect to lose business to more agile and customer-centric competitors. An onboarding process that requires an office visit to show a passport and sign a form imposes inconveniences that new banking customers are increasingly unwilling to put up with—especially if they can effortlessly turn to alternatives that allow them to open an account online, authenticate their identity instantly, and start transacting in minutes.

To win over consumers in this emerging digital reality, banks must break with outdated practices that place bothersome and unnecessary obligations on new customers. Anything less than a simple, safe, and completely online experience is fast becoming outdated, and will soon be obsolete.

If you'd like find out if we evaluated the onboarding and KYC process at your institution, please email us and we'd be happy to share our findings and insights with you.*