Apr 17, 2025

How Fourthline and N26 are turning customer security into an engine of growth.

The Fourthline Team

Introduction

For digital-first banks, building a seamless product experience is just the beginning. The real challenge comes next, when you have to secure your platform against digital crime every day to maintain your customers’ trust – a currency more valuable than capital itself.

The founders of German neobank N26 know this better than most. They also knew that to scale a fully mobile finance platform across Europe, they would need to address the security concerns of potential customers, adhere to the increasingly complex compliance requirements of multiple countries, and stave off the rising threat of financial crime.

Easy, right?

No, but possible — with the right partner.

Fourthline x N26: A shared vision of scaling responsibly

N26 teamed up with Fourthline in 2017, at a moment of accelerated growth that brought new challenges in identity verification, fraud, and regulatory oversight. Together, we tackled these challenges head-on, developing a robust set of financial security measures and a shared vision of responsible innovation.

We’re excited to share that vision with you in the following pages, because we believe security is the core element of a successful fintech playbook. Ultimately, there’s simply no substitute for effective security measures that stop digital threats before they can impact your customers and their funds.

In every challenge lies an opportunity. As Fourthline and N26 have learned over the past several years, the right approach to security – one that leverages advanced biometrics, ethical AI, and cutting-edge authentication technologies – is the surest path to growth at scale.

Contents:

"Know Your Customer" is more then an acronym

Continuous authentication throughout the customer lifecycle

Growth, done the smart way

Fourthline x N26: Looking toward the future, together.

KYC is more than an acronym

If you’ve spent any time in the financial services industry, you’re likely familiar with KYC – a stringent set of guidelines and regulations put in place to ensure that you ‘know your customer’ before starting up a business relationship with them.

That seems straightforward enough. But what used to be a fairly standard process has become remarkably complex in the era of AI deepfakes, digital document manipulation, and ever-more-sophisticated approaches to identity theft.

Banking’s digital transformation has opened new opportunities for customers, but it has also created new frontiers online that criminals attempt to exploit. To sort the former from the latter without degrading the experience of the product throughout the customer lifecycle, Fourthline and N26 implemented a full suite of advanced biometric identification technologies, including:

Facial recognition based on advanced machine-learning techniques, which extract patterns and attributes to identify faces in real time, regardless of changes in age or facial hair, glasses, and different angles.

Liveness detection that flags pre-recorded videos or counterfeit content to ensure that only authentic, live videos of the applicant pass the verification process.

Real-time database searches and alert list comparisons, which help N26 determine whether the face of a prospective client exists in databases of known fraudsters.

"You can’t downstream KYC. We can lean on Fourthline and other identification partners to step in at the verification level to ensure fraudsters are blocked from getting on our platform in the first place."

Continuous authentication throughout the customer lifecycle

Partnering with Fourthline as one of its identification partners, N26 manages to limit fraudsters coming to the bank platform as much as possible by developing stringent security measures for every stage of the customer lifecycle.

These measures don’t stop when customers successfully pass the initial KYC and authentication checks. In fact, that’s just the beginning of a continuous cycle of identity verification that keeps customers protected for as long as they hold their N26 accounts.

Fourthline’s continuous authentication measures include seamless biometric re-authentication when pairing new devices. All the customer needs to do is take a current selfie and live video; the check itself takes place in the background and is finished in seconds.

Machine learning detection in action: a case study

THE BACKGROUND

A ‘money mule’ is a person fraudsters use to illegally move money. This is a well-known money laundering tactic, though the people used as money mules may or may not be aware that they’re facilitating fraud.

As is common for banks of sufficient scale, N26 has faced a number of money mule attempts – and a recent case demonstrates how Fourthline’s technology helps them flag and stop these attempts.

THE ATTEMPT

A group of fraudsters recruited a money mule in an EU country to open a legitimate account, then attempted to remotely take over the account from their base in a non-EU country. Their big mistake? Trying to fool N26 and Fourthline's authentication system with a pre-recorded video.

The geolocation feature of the Fourthline Identity Verification Solution raised the first red flag. Then, when the fraudsters attempted to bypass security checks using a ‘video of a video’ (i.e. a pre-recorded selfie video held up to the camera) for authentication, Fourthline's biometric authentication technology immediately alerted N26’s security team.

THE OUTCOME

The system detected the location mismatch, fake biometric data, and suspicious timing of the transaction within seconds. N26's security team swiftly closed the compromised account, proving that, with the right tools, even the most sophisticated fraudsters can be caught by their own reflection.

AML, fueled by Fourthline

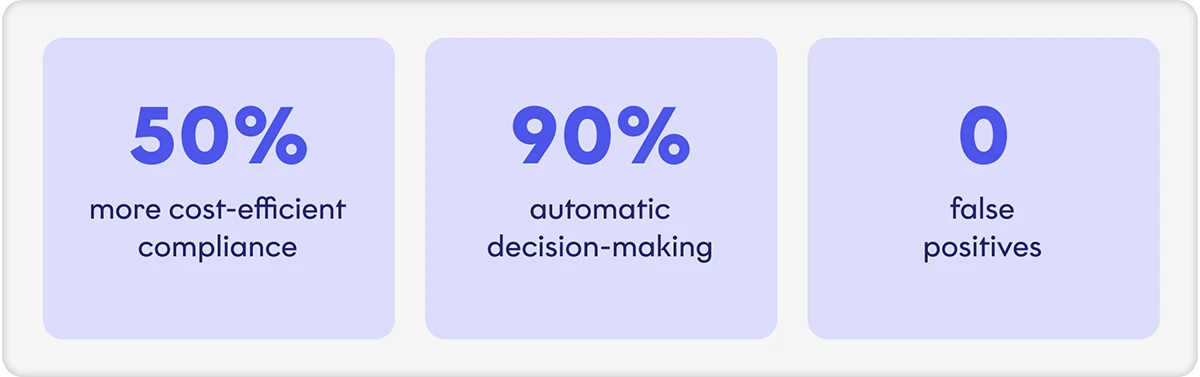

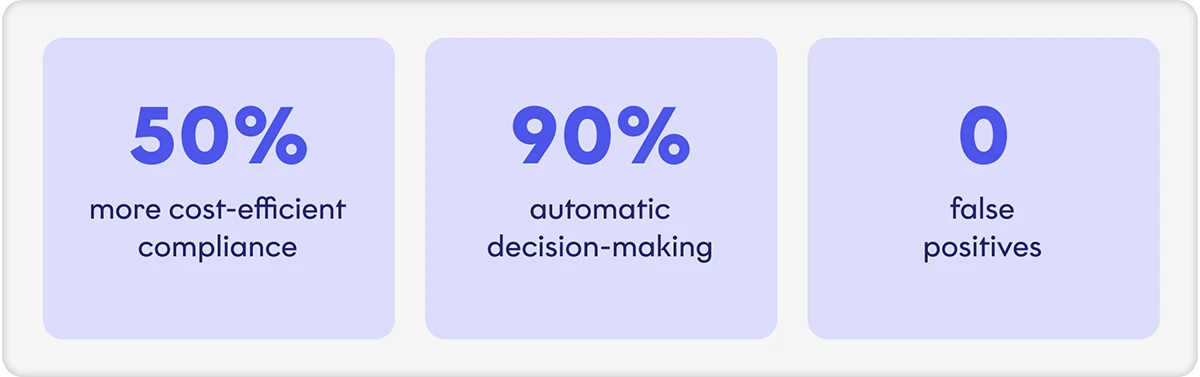

How do we measure the success of our AML efforts? By looking at the metrics our partners care about the most.

Growth, done the smart way

As it expanded across two dozen European markets, N26 worked alongside Fourthline to develop robust security tools that leverage leading-edge machine learning and digital technologies.

Our responsible approach to security includes:

Facial recognition as an alternative to passwords

Two-factor authentication with biometric scanning on paired devices

Centralized analytics that continually cross-reference customer data

A shared commitment to data governance and machine learning

As a fully licensed bank, N26 faces the same regulatory requirements as its bricks-and-mortar counterparts. And as a fully digital bank, it operates under rigorous security and data protection standards.

N26 meets these standards by working with Fourthline to invest heavily in security and develop a clear, ethical approach to data governance. Both partners are fully compliant with GDPR and local banking regulations in every market N26 serves.

“A bank that’s entirely online needs to have a strong relationship with regulators,” says Nadine Kari, Group MLRO at N26. “But this relationship also empowers N26 and Fourthline to adapt and innovate new ways to protect customers” – even as we expand the biometric features of N26’s online banking experience.

Fourthline x N26: Looking toward the future, together

N26 and Fourthline have come a long way together. You might even say we’ve grown up as siblings of a sort, navigating the headwinds of regulatory complexity and financial crime to emerge stronger than ever.

Here’s what we’ve learned: to scale with confidence, you need security partners you can depend on. It’s remarkable to think that a fully digital bank is now ahead of the curve in terms of financial crime prevention.

But there’s plenty of work left to do.

Staying ahead of emerging fraud threats

Need evidence of how quickly new threats can emerge? In the first month of the 2020 COVID-19 pandemic, coronavirus-related phishing attacks rose by 667% globally. More recently, the explosion of machine learning tools has led to a similar boom in online payment fraud, which is projected to jump from $38 billion in 2023 to $91 billion in 2028.

N26 customers stayed protected during this tumultuous time, thanks in part to best-in-class prevention models and a rock-solid partner in Fourthline. Moving forward, we’re working together to detect and fend off a host of emerging threats in the fintech space, including:

Bots and deep fakes

Aggregated attacks

Biometric manipulators

“Machine learning will continue to develop on both sides: the good and the bad. That's why partnerships like ours are essential. We see patterns and exchange information – and that's how we stay ahead.”

Nadine Kari | Group MLRO - N26

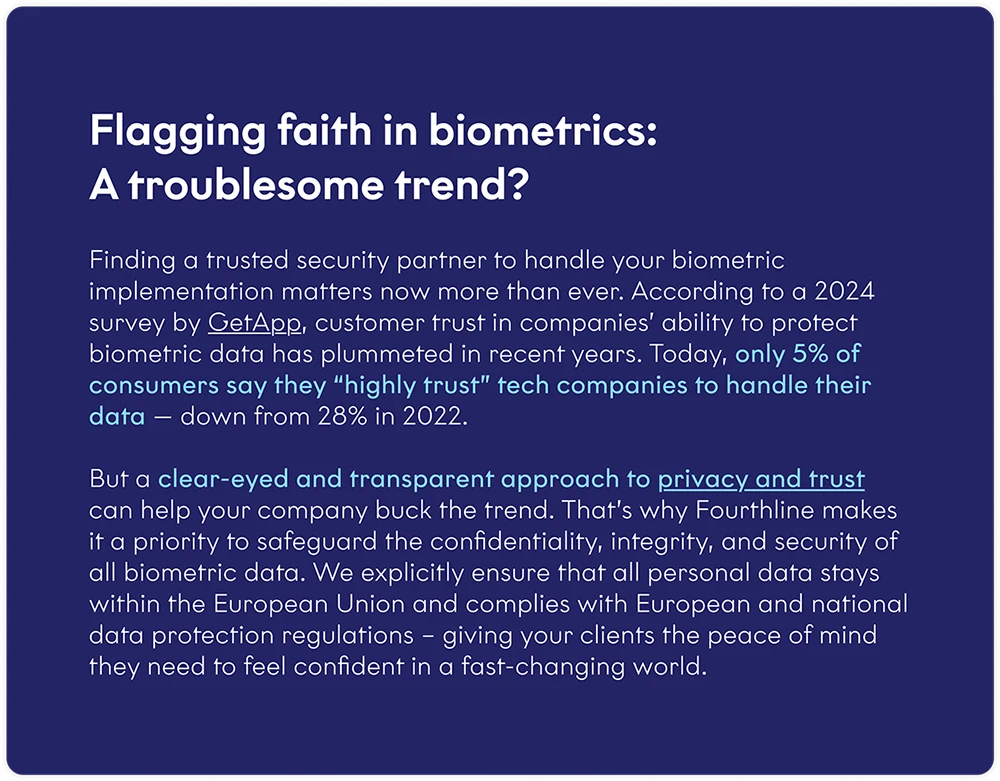

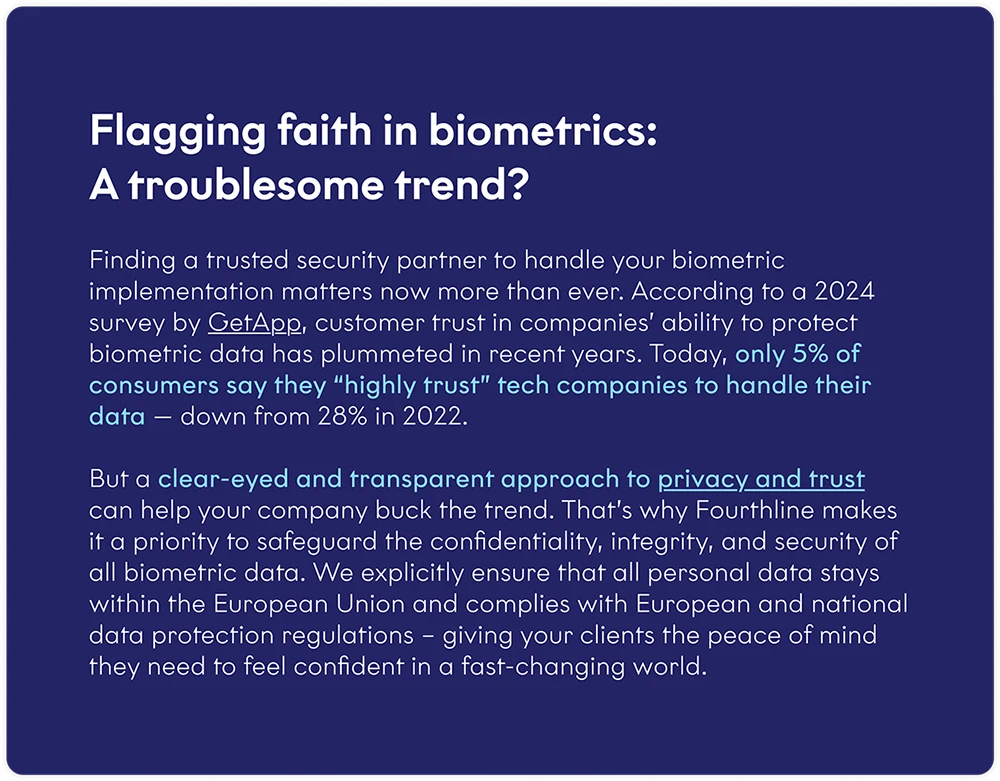

Unlocking the Full Potential of Biometrics

It’s clear that biometric implementations will play an outsized role in protecting against financial crime in the future.

And, it’s clear that neobanks like N26 will continue to lean on partners they can trust to protect customers’ data and privacy while delivering best-in-class security.

In other words, they need partners like Fourthline.

Introduction

For digital-first banks, building a seamless product experience is just the beginning. The real challenge comes next, when you have to secure your platform against digital crime every day to maintain your customers’ trust – a currency more valuable than capital itself.

The founders of German neobank N26 know this better than most. They also knew that to scale a fully mobile finance platform across Europe, they would need to address the security concerns of potential customers, adhere to the increasingly complex compliance requirements of multiple countries, and stave off the rising threat of financial crime.

Easy, right?

No, but possible — with the right partner.

Fourthline x N26: A shared vision of scaling responsibly

N26 teamed up with Fourthline in 2017, at a moment of accelerated growth that brought new challenges in identity verification, fraud, and regulatory oversight. Together, we tackled these challenges head-on, developing a robust set of financial security measures and a shared vision of responsible innovation.

We’re excited to share that vision with you in the following pages, because we believe security is the core element of a successful fintech playbook. Ultimately, there’s simply no substitute for effective security measures that stop digital threats before they can impact your customers and their funds.

In every challenge lies an opportunity. As Fourthline and N26 have learned over the past several years, the right approach to security – one that leverages advanced biometrics, ethical AI, and cutting-edge authentication technologies – is the surest path to growth at scale.

Contents:

"Know Your Customer" is more then an acronym

Continuous authentication throughout the customer lifecycle

Growth, done the smart way

Fourthline x N26: Looking toward the future, together.

KYC is more than an acronym

If you’ve spent any time in the financial services industry, you’re likely familiar with KYC – a stringent set of guidelines and regulations put in place to ensure that you ‘know your customer’ before starting up a business relationship with them.

That seems straightforward enough. But what used to be a fairly standard process has become remarkably complex in the era of AI deepfakes, digital document manipulation, and ever-more-sophisticated approaches to identity theft.

Banking’s digital transformation has opened new opportunities for customers, but it has also created new frontiers online that criminals attempt to exploit. To sort the former from the latter without degrading the experience of the product throughout the customer lifecycle, Fourthline and N26 implemented a full suite of advanced biometric identification technologies, including:

Facial recognition based on advanced machine-learning techniques, which extract patterns and attributes to identify faces in real time, regardless of changes in age or facial hair, glasses, and different angles.

Liveness detection that flags pre-recorded videos or counterfeit content to ensure that only authentic, live videos of the applicant pass the verification process.

Real-time database searches and alert list comparisons, which help N26 determine whether the face of a prospective client exists in databases of known fraudsters.

"You can’t downstream KYC. We can lean on Fourthline and other identification partners to step in at the verification level to ensure fraudsters are blocked from getting on our platform in the first place."

Continuous authentication throughout the customer lifecycle

Partnering with Fourthline as one of its identification partners, N26 manages to limit fraudsters coming to the bank platform as much as possible by developing stringent security measures for every stage of the customer lifecycle.

These measures don’t stop when customers successfully pass the initial KYC and authentication checks. In fact, that’s just the beginning of a continuous cycle of identity verification that keeps customers protected for as long as they hold their N26 accounts.

Fourthline’s continuous authentication measures include seamless biometric re-authentication when pairing new devices. All the customer needs to do is take a current selfie and live video; the check itself takes place in the background and is finished in seconds.

Machine learning detection in action: a case study

THE BACKGROUND

A ‘money mule’ is a person fraudsters use to illegally move money. This is a well-known money laundering tactic, though the people used as money mules may or may not be aware that they’re facilitating fraud.

As is common for banks of sufficient scale, N26 has faced a number of money mule attempts – and a recent case demonstrates how Fourthline’s technology helps them flag and stop these attempts.

THE ATTEMPT

A group of fraudsters recruited a money mule in an EU country to open a legitimate account, then attempted to remotely take over the account from their base in a non-EU country. Their big mistake? Trying to fool N26 and Fourthline's authentication system with a pre-recorded video.

The geolocation feature of the Fourthline Identity Verification Solution raised the first red flag. Then, when the fraudsters attempted to bypass security checks using a ‘video of a video’ (i.e. a pre-recorded selfie video held up to the camera) for authentication, Fourthline's biometric authentication technology immediately alerted N26’s security team.

THE OUTCOME

The system detected the location mismatch, fake biometric data, and suspicious timing of the transaction within seconds. N26's security team swiftly closed the compromised account, proving that, with the right tools, even the most sophisticated fraudsters can be caught by their own reflection.

AML, fueled by Fourthline

How do we measure the success of our AML efforts? By looking at the metrics our partners care about the most.

Growth, done the smart way

As it expanded across two dozen European markets, N26 worked alongside Fourthline to develop robust security tools that leverage leading-edge machine learning and digital technologies.

Our responsible approach to security includes:

Facial recognition as an alternative to passwords

Two-factor authentication with biometric scanning on paired devices

Centralized analytics that continually cross-reference customer data

A shared commitment to data governance and machine learning

As a fully licensed bank, N26 faces the same regulatory requirements as its bricks-and-mortar counterparts. And as a fully digital bank, it operates under rigorous security and data protection standards.

N26 meets these standards by working with Fourthline to invest heavily in security and develop a clear, ethical approach to data governance. Both partners are fully compliant with GDPR and local banking regulations in every market N26 serves.

“A bank that’s entirely online needs to have a strong relationship with regulators,” says Nadine Kari, Group MLRO at N26. “But this relationship also empowers N26 and Fourthline to adapt and innovate new ways to protect customers” – even as we expand the biometric features of N26’s online banking experience.

Fourthline x N26: Looking toward the future, together

N26 and Fourthline have come a long way together. You might even say we’ve grown up as siblings of a sort, navigating the headwinds of regulatory complexity and financial crime to emerge stronger than ever.

Here’s what we’ve learned: to scale with confidence, you need security partners you can depend on. It’s remarkable to think that a fully digital bank is now ahead of the curve in terms of financial crime prevention.

But there’s plenty of work left to do.

Staying ahead of emerging fraud threats

Need evidence of how quickly new threats can emerge? In the first month of the 2020 COVID-19 pandemic, coronavirus-related phishing attacks rose by 667% globally. More recently, the explosion of machine learning tools has led to a similar boom in online payment fraud, which is projected to jump from $38 billion in 2023 to $91 billion in 2028.

N26 customers stayed protected during this tumultuous time, thanks in part to best-in-class prevention models and a rock-solid partner in Fourthline. Moving forward, we’re working together to detect and fend off a host of emerging threats in the fintech space, including:

Bots and deep fakes

Aggregated attacks

Biometric manipulators

“Machine learning will continue to develop on both sides: the good and the bad. That's why partnerships like ours are essential. We see patterns and exchange information – and that's how we stay ahead.”

Nadine Kari | Group MLRO - N26

Unlocking the Full Potential of Biometrics

It’s clear that biometric implementations will play an outsized role in protecting against financial crime in the future.

And, it’s clear that neobanks like N26 will continue to lean on partners they can trust to protect customers’ data and privacy while delivering best-in-class security.

In other words, they need partners like Fourthline.

Solutions

Solutions

Fourthline has been certified by EY CertifyPoint to ISO/IEC27001:2022 with certification number 2021-039.

Copyright © 2026 - Fourthline B.V. - All rights reserved.

Fourthline has been certified by EY CertifyPoint to ISO/IEC27001:2022 with certification number 2021-039.

Copyright © 2026 - Fourthline B.V. - All rights reserved.