Aug 2, 2023

Composability: where compliance meets core banking

The Fourthline Team

There is nothing better than pursuing innovation with efficiency, especially when security is at stake, and the partnership between Mambu and Fourthline is aiming to achieve exactly this. As these two companies join forces, the promise is that customer experiences will rapidly change, shifting towards seamlessness and ease because two of the best players on the market are the ones holding the reins.

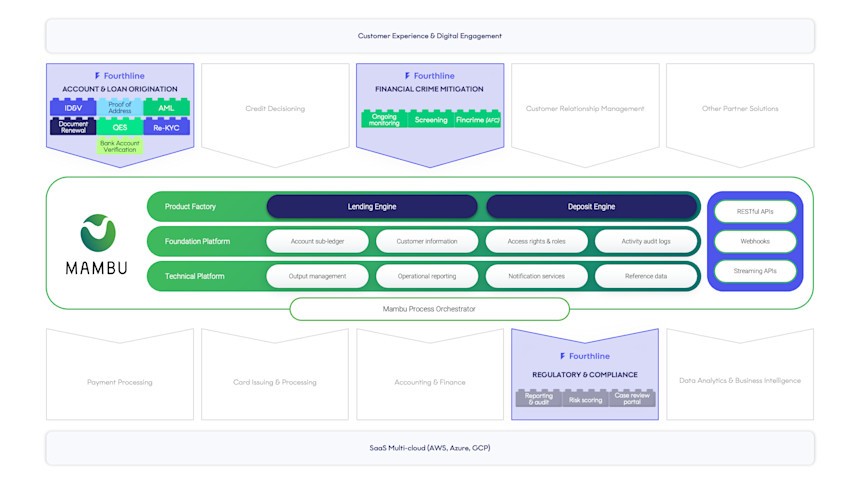

So, what exactly is the goal of this dynamic partnership? The answer lies in the perfect harmony between our offerings, for a start, Fourthline’s “composable” compliance solutions and their ability to scale across diverse European markets. This aligns seamlessly with the composable banking philosophy of Mambu’s cloud banking platform, which supports financial institutions as they design nearly any type of financial offering. Together, we can help banks build their services with improved speed and efficiency and do all this in a secure and compliant way through the single API integration, which covers the European market in its entirety.

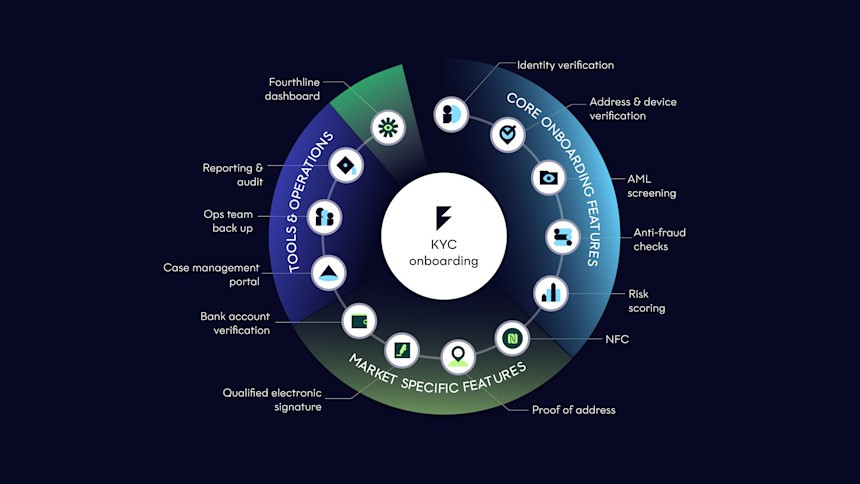

Mambu and Fourthline help financial institutions provide their customers with a streamlined onboarding journey. Fourthline, armed with a blend of AI-driven checks and human expertise, is the one to digitally verify users’ real identities, and do this with increased ease and speed, leading to an onboarding journey that is unmatched. Their fully modular and scalable know-your-customer (KYC) solution includes all steps required to meet the standards of the European regulatory landscape. This compliance is achieved by a verification process that covers a wide range of checks in order to authenticate a user’s identity with the highest level of certainty. This means identity verification (ID&V) with optional near field communication (NFC), liveness checks, device data and geolocation analysis, and additional anti-money laundering (AML) screenings with investigations, risk scoring, customer due diligence (CDD) reporting, and an audit trail. The elements that make up the Fourthline platform are available as both an end-to-end solution and now as standalone products. This top-notch solution is made possible by a stack of proprietary technology and an AML and fraud expert team, a fusion that sets new industry benchmarks in fraud prevention, compliance, and data security. Consequently, businesses can trust the real identities of their customers without compromising the pace and ease of the onboarding journey.

“There’s nothing quite like the harmony of innovation and efficiency, especially when it comes to safeguarding security. The strength behind this partnership, is that by setting new benchmarks in speed, security, and compliance, we will unlock seamless onboarding journeys for financial institutions,” Jacky Uys, Head of Solution Engineering at Fourthline.

Now, let’s uncover some additional benefits of the partnership. The essence of Fourthline is flexibility and customisability. It offers both an end-to-end compliance solution and a custom-composed approach tailored to specific use cases, such as issuing Qualified Electronic Signatures or AML & PeP screening. Leveraging Fourthline’s agility, Mambu customers can rely on their services for onboarding, either by outsourcing compliance to Fourthline completely, or through utilising its platform as a software-as-a-service (SaaS) capability. In any case, by using Fourthline’s KYC capabilities, one can manage customer lifecycle compliance in a unified way instead of the need for multiple expensive point solutions that pose a higher risk of non-complying. On top of this, by choosing a seamless integration instead of working with scattered pieces, managing data pipelines instantly becomes a breeze.

“The partnership between Mambu and Fourthline represents an exciting union of two industry leaders, determined to improve scalability while remaining compliant. With a shared commitment to innovation and security, we are thrilled to bring a seamless and efficient experience to customers,” Serkan Ünal, Head of Strategic Partnerships at Fourthline.

But the advantages do not just stop here as they extend to both companies and the respective clients they work with. Fourthline, already a trusted solution in Mambu’s partner ecosystem, has an impressive client portfolio boasting renowned names like Trade Republic, Western Union, and N26. This speaks volumes about the reliability and excellence of Fourthline’s capabilities.

With all of this, the value behind the union is now clear, however, the question remains what this partnership will look like in practice. Mambu and Fourthline are joining forces to build state-of-the-art solutions for their mutual clients in the financial sphere. The combined expertise of Mambu and Fourthline provides you with collective knowledge on the joint merits of core banking and KYC. Furthermore, to make accessing information even more simplistic, this unity is fortified with a comprehensive API documentation library.

Now, let’s explore how this partnership will affect the broader industry and the market. Together, these two companies have the potential to reshape how financial institutions conduct customer onboarding, leading to an ID&V process that is faster than before, while maintaining even higher standards of security. The resulting system is one of efficiency and ease without the compromise of decreased quality. This is achieved by Mambu supplying the core banking engine, which, in combination with Fourthline’s industry-leading user authentication product suite, is capable of real-time risk and fraud management that keeps pace with the rapidly evolving regulatory landscape. To add another layer of ease, integrating this service can be tailored given the plug-and-play capability based on a composable building block methodology, facilitating fiction-free account origination and configuration. The overall result is an entirely new onboarding journey that fuses compliance with core banking, enabling financial institutions to meet the rapidly changing expectations of our time.

In conclusion, the partnership between Mambu and Fourthline is a game-changer redefining compliance solutions and customer onboarding experiences. Together, it offers a winning combination of speed, security, and scalability, leading to enhanced standards in the financial industry. This future is compliant, with seamlessness and efficiency, and the best part about it is that it’s already here.